Updated: 12 February 2024.

The Holidays Act 2003 has been around a good while now, but many New Zealand employers still struggle with public holiday regulations and correctly paying employees.

The Act is quite complex (thankfully, it has been reviewed and changes are slated in the next few years), but every employer needs to correctly calculate and pay public holidays. Not only is it an essential part of leave management and payroll, it’s also a legal requirement.

So I’ve written this short guide on paying public holidays. It doesn’t attempt to cover every public holiday scenario, as there are many moving parts.

Instead, it provides an overview and answers some of the questions we commonly receive from New Zealand businesses.

Public holiday entitlements

Employees are entitled to a paid day off for a public holiday if that day falls on a day that the person would have normally worked (if the day wasn't a public holiday). These are known as ‘otherwise working days’.

Otherwise working days for people on fixed work schedules

Public holidays are pretty simple for any worker with a fixed working schedule (whether part-time or full-time).

Ask yourself: is the public holiday a day the person would normally work?

This test is easy to apply for any employee with a fixed work pattern. For example, a regular Monday to Friday, 40-hour-a-week employee will most likely receive all 12 public holidays every year. The only times they might miss out is if they are off work on unpaid leave for some reason.

Another example: if a person has a fixed, part-time pattern of working every Tuesday to Thursday, they won't work on public holidays that fall on a Monday or a Friday so won't receive any payments for those days.

Otherwise working days for people on variable schedules

Variable work schedules can present challenges, but most employers still operate a roster system and you can rely on this to determine who gets a public holiday.

Where the rostered days naturally rotate to fall on the public holiday, it is an otherwise working day, so those employees get the public holiday entitlement. Where the roster naturally rotates so the public holiday is a rostered day off, the public holiday is not an otherwise working day.

You must also look at the employment agreement to ensure you are meeting any entitlements specified in there, e.g. specific times and days they work.

You cannot adjust the roster or take an employee off the roster so that they miss out on the public holiday.

If you are in doubt about otherwise working days because of the employee’s work pattern, review their average pattern over the previous 4 weeks.

In the case of someone covering a shift for someone else on a public holiday, if it is not that person’s usual working day, they get paid time-and-a-half and the person whose shift it normally is gets paid a public holiday taken.

What to pay staff

Having established whether the day is an otherwise working day, you then have to look at what to pay.

If the person had the day off

- If the day is an otherwise working day, the employee receives payment for the day off.

- If the day is not an otherwise working day, they get the day off but don’t receive payment.

If the person worked

- If the day is an otherwise working day, they get payment of time-and-a-half, plus an alternative holiday (day in lieu).

-

If the day is not an otherwise working day, they get payment of time-and-a-half but no alternative holiday.

Casual staff

Casual employees typically do not have ‘regular’ working days as their employment is on an as-needed basis. Therefore, casuals are paid time-and-a-half for working on a public holiday. However, if for any reason they have regularly worked that day, they need to be paid time-and-a-half and given an alternative holiday.

Find out more about paying part-time and casual staff.

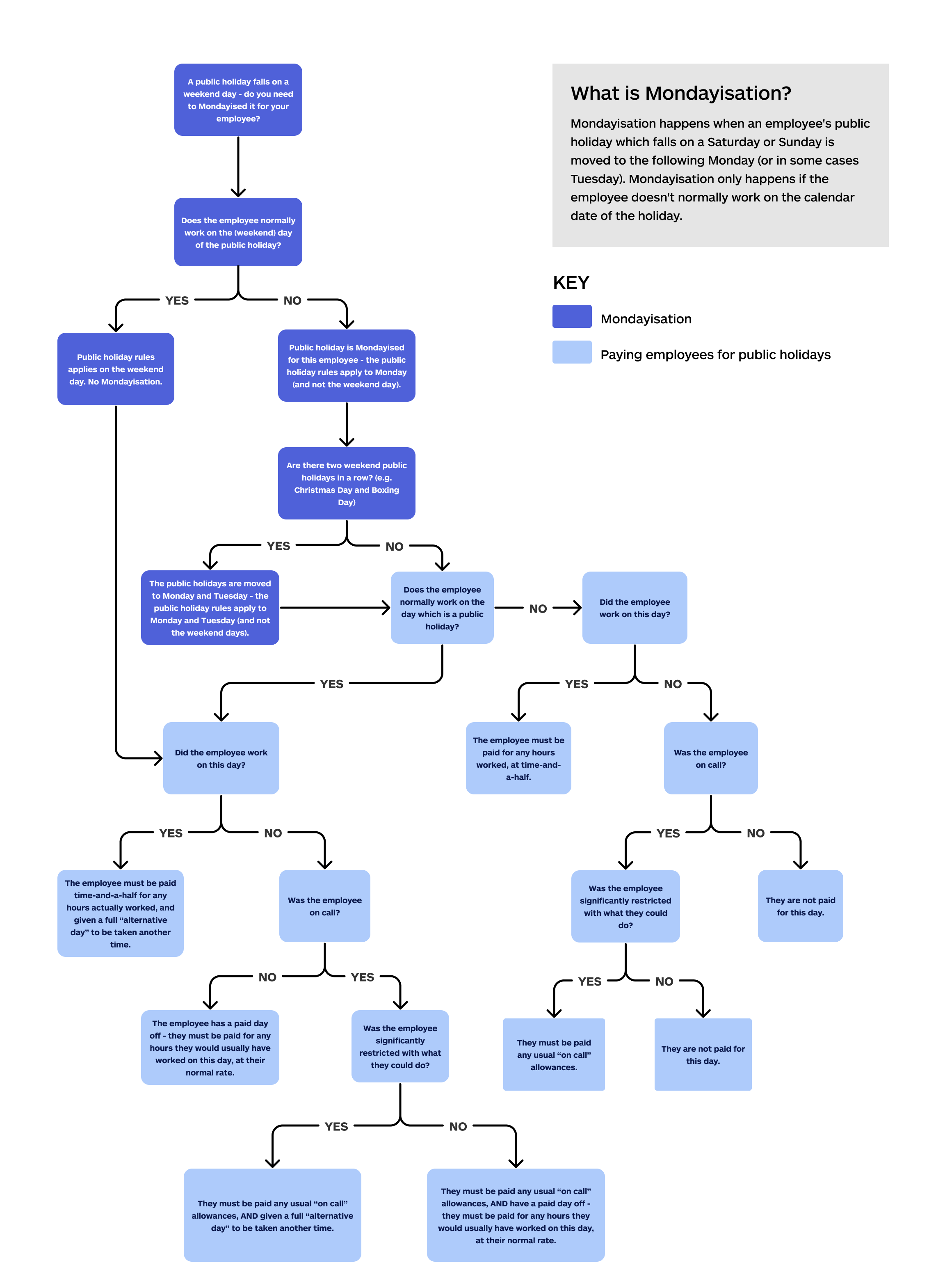

When holidays fall on a weekend (‘Mondayisation’)

When a public holiday falls on a Saturday or Sunday, an employee’s public holiday might be moved to the following Monday (or in some cases Tuesday).

This ‘Mondayisation’ only happens for employees who would not normally work on the calendar date of the public holiday. Employees that would normally work on the calendar date don’t have the public holiday benefits moved to Monday.

Employees can’t ‘double dip’ and have 2 public holidays. So, in the case that an employee would normally work on both the calendar date of the public holiday and the day it is observed, their public holiday is on the calendar date.

Download a copy of the Mondayisation cheat sheet.

Can I insist that employees work on a public holiday?

Any employee can work on a public holiday if they agree to do so, but an employer can only insist that an employee works on a public holiday if their employment agreement has a clause specifying this and the public holiday is an otherwise working day for the person.

Taking leave on a public holiday

If an employee is on leave, e.g. annual leave, on the day a public holiday falls, they are paid for the public holiday and not annual leave, even if your business is open and they have requested the day off.

If an employee gets sick

If you have rostered somebody to work on the public holiday and they are sick, they qualify for a paid public holiday. Here’s a great summary straight from the Employment.govt.nz website:

“When an employee would have worked on a public holiday but is sick or bereaved, the day is treated as a paid unworked public holiday and the employee would be paid their relevant daily pay or average daily pay, but would not be entitled to time-and-a-half or an alternative holiday; no sick or bereavement leave is deducted.”

Transferring days off

Public holidays can be transferred by agreement between the employer and employee. Often people will want to transfer a public holiday that falls on a Tuesday, Wednesday, or Thursday to a Monday or Friday, so they have a long weekend.

By agreement with employees, you can move the public holiday and grant a long weekend. Employees would receive payment for the day off work, e.g. the Monday, as the transferred public holiday and the Tuesday would now be a normal working day; they attend work and get paid normal time, with no alternative holiday.

This must be in writing and must be agreed upon. If your workplace cannot accommodate this transfer, you do not have to agree to an employee transfer request. Equally, you cannot force a transfer if the purpose of the transfer is to reduce entitlements.

Taking alternative days (days in lieu)

When an employee takes their alternative day is up to the employer and the person. Like other types of leave, we recommend allowing people to take the day’s leave when they ask for it unless there is a genuine reason why you cannot accommodate this.

The employee is paid for the day as if it were a day they worked.

Pay-outs

If the employee doesn't take their alternative day within 12 months of being entitled to it, you and the employee can agree to have it paid out.

Stand-down or qualifying periods

We sometimes get asked if there is a stand-down period or qualifying period before an employee receives a public holiday entitlement and the answer is no, there is no qualifying period.

Employees are entitled to public holidays from their first day of work.

Restricted trading days

There are 3-and-a-half days when the majority of shops must be closed under the Shop Trading Hours Act 1990. These days are:

- Christmas Day (a public holiday).

- Good Friday (a public holiday).

- Easter Sunday (not a public holiday).

- ANZAC Day, until 1.00 pm on 25 April (a public holiday).

Almost all shops are required to be closed, other than shops with exclusions either due to the nature of their trade (petrol stations, cafes etc.), or those with area exemptions as prescribed by local Council bylaws.

What to pay employees on restricted trading days

If your business can't offer people their usual working hours due to shop trading restrictions, you still need to pay them their minimum contractual hours of work for the relevant pay period.

To do this, you need to ensure you can either:

- Make the additional hours available to them within the pay period, so they have the ability to work their contractual hours; or

- Pay them in lieu of working, in good faith.

If the above two options aren’t viable for your business, it may be possible to negotiate reduced hours of work during the impacted pay periods. This consultation with employees needs to occur well in advance of the public holidays.

As always, if you are confused or have a very specific and/or unusual scenario, then consult an expert. The team at MyHR is available to help you get this right.